The Truth About Money using Cash Flow Modelling

A visual representation of your goals

When clients approach us for advice, they want to know if they are saving enough into pensions and other investments for retirement, whether they can afford to retire early and not run out of money. It might seem like a crystal ball would be needed to answer those questions, but our process works very well without one, so we can answer these with ease.

Using cashflow modelling via our Truth About Money service, we will show where you are headed for now, and what needs to change for you to experience the fulfilling lifestyle you deserve.

When we build your initial plan, we do not just consider the day-to-day costs like food, utilities, and transport, we also focus on the more extravagant future expenditures. We consider hobbies, interests you wish to pursue, any community or charitable projects you want to undertake, big-ticket items like a one-off world travel plans and, anything else you might want to do on the way to and into retirement.

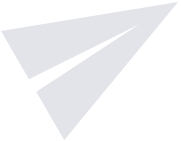

Example only

Example only

We dig deep, ask questions, and work with clients to answer:

- What do you want to achieve between now and the day you die?

- When can you stop doing what you no longer enjoy?

- When can you start doing more of the things you love?

- What gives your life meaning or purpose?

- What needs to happen to secure your family’s future?

- What do you need to sell your business for to live life with no fear of running out of money?

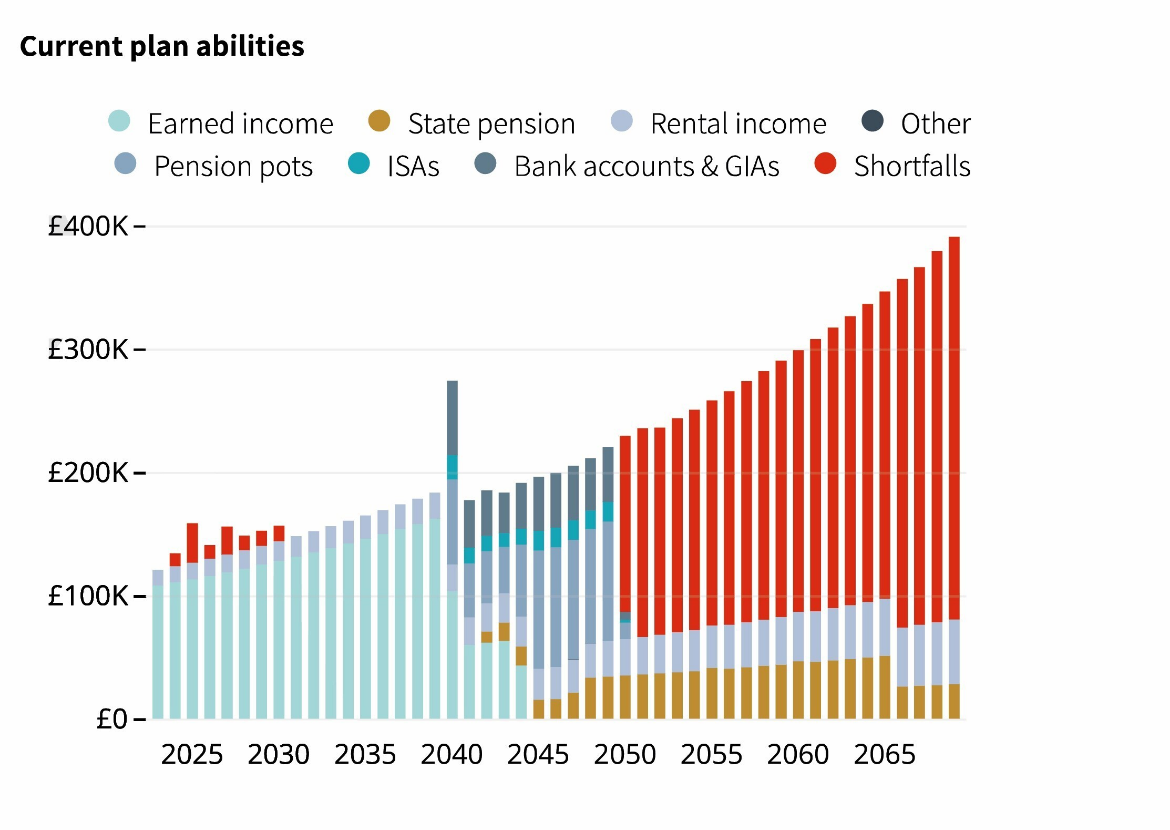

Example only

Example only

The biggest question of all… how much is enough?

The best financial plans bring human connection and the power of technology together to create something greater than either could do alone.

Our Truth About Money service helps deliver personalised advice and honours your bespoke needs. It helps you engage more deeply with the planning process. We shun the jargon used by traditional advisers by allowing you to understand the impact of a strategy and monitor progress in real-time, providing you with real-life results.

We charge a fixed fee of £800 for a “Where are you now” report. However, if you would like further planning and ideas with a variety of scenarios programmed in, we will charge an additional fee. We will disclose the exact amount during our initial meeting

How it will benefit you…

- It provides you with a visual forecast of your finances, so you will be better informed before you make any big and long-lasting decisions.

- You can see your finances laid out in front of you, rather than being bombarded with figures.

- It could help you set short, medium, and long-term goals, allowing you to think about your future in a way you have never done before.

- It could show you what would happen if you unexpectedly lost your income through job loss, illness, or death.

- You could explore many different scenarios and see the outcomes of each.

- We can help answer, “what if” questions such as: “What if I gift money to children?” and “What if I inherited some money or assets?” or “What if I retired early?”

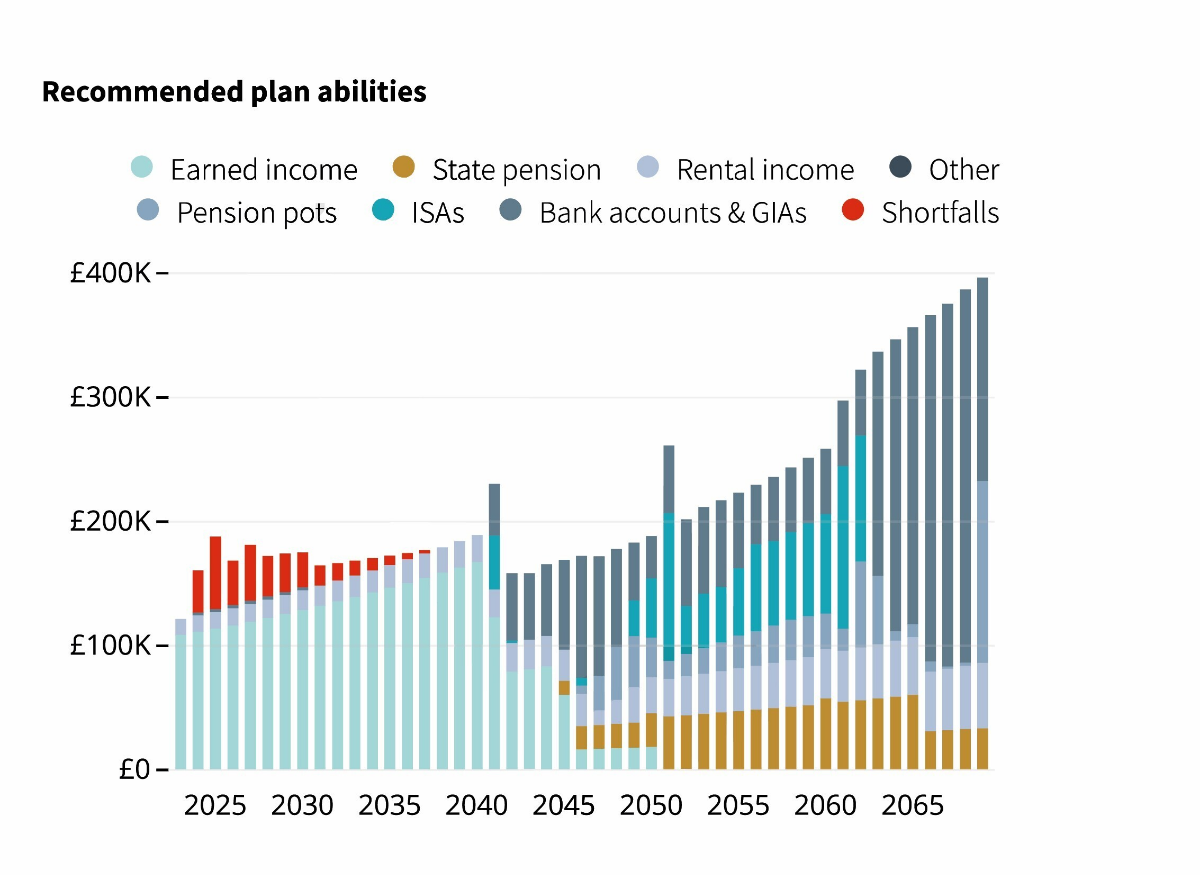

Example only

Example only

Financial wellbeing

Retirement

Legacy

We will review your goal progress

An important part of your financial story is to understand the impact of the advice strategies provided on your plan. We will check in to see where you are currently and where you could be if you took action.