How we charge

Not many financial advisers publish their fees on their websites. We do, because we believe in being transparent about how we charge for the work we do.

We also completely believe in the value we provide to our clients. In fact, research published by the International Longevity Centre UK (ILC) shows that those who receive professional financial advice boost their wealth by an average of £47,000*

Our clients have also told us how much they appreciate our advice and guidance – just take a look at their testimonials below.

We can offer a planning only service, without the requirement to take ongoing advice. However, we can provide the best value to those clients who choose to work with us over the long term.

* ILC Report: Peace of mind: Understanding the non-financial value of financial advice, written 16/11/2020.

Below are details of how we charge for each step of your journey with us:

1. Discover

The first step is to find out how your journey might look! We’ll discuss your financial objectives and goals, uncovering your priorities and timelines for achieving them. Where we are considering your investment needs, we’ll discuss your attitude and experience of investing, as well as the level of risk you can afford to take.

Our charges

There is no charge to you for this step of your journey. All of the time we invest at the ‘discover’ stage is entirely at our expense.

2. Research & advice

With the information we have obtained from the ‘discover’ stage, we will create a plan which aims to achieve your financial goals. We’ll investigate which products will be most suitable for your needs. At this point, we will agree on the initial and ongoing fees required to deliver your plan.

Our charges

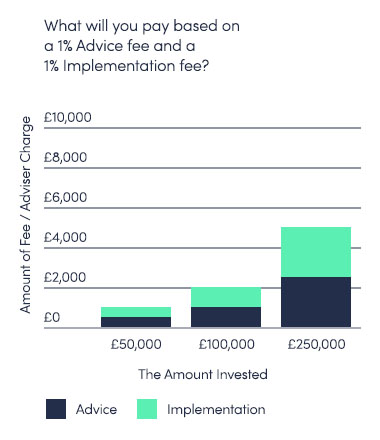

Investments and Pensions, Option 1: A percentage(%) of the amount invested. Please note that these are maximums for each tier, which means actual charges will be case dependent and probably lower.

£0 -> £250,000: 3% Maximum charge £7,500

£250,001 -> £500,000: 2% Maximum charge £5,000

£500,001 -> £750,000: 1% Maximum charge £2,500

£750,001 -> £1,000,000: 1% Maximum charge £2,500

Over £1,000,000: 0% Maximum charge £0

The overall charge in this example would be £17,500 and assumes the maximum charge has been applied to each tier.

Investments and Pensions, Option 2: Per hour. We will provide you with a bespoke estimate of the time required before we commence any work and will not charge for any further work unless agreed with you. Typically, the charge is £250 per hour, (no VAT when we act as an intermediary between a client and a product provider).

The time taken to undertake the work will depend on the complexity of the matter. For instance, a single ISA recommendation will typically take 4 hours and an IHT solution involving several recommendations will typically take 20 hours.

Investments and Pensions, Option 3: Fixed charge. We will confirm the fee amount once we have scoped the task and amount of work due.

Mortgages

There is no charge to you for this step of your journey. All of the time we invest up to this point is entirely at our expense.

Equity Release Mortgages

There is no charge to you for this step of your journey. All of the time we invest up to this point is entirely at our expense.

3. Implementation

We recommend and implement your strategy after explaining it to you. We will assist in the completion of any relevant paperwork, ensuring the documentation is processed as quickly and efficiently as possible.

Our charges

Investments and Pensions

There is no charge to you for this step of your journey. All of the time we invest at this stage is entirely at our expense.

Mortgages

There is no charge to you for this step of your journey, but we do charge a minimum of £800 when you receive your mortgage offer. Our minimum total earnings must be £1,500, some of which we will receive from the mortgage lender. You will be notified of this when we provide you with the mortgage illustration from the recommended lender.

For difficult mortgages or ones with poor credit, please speak to us for a bespoke quote.

Equity Release Mortgages

There is no charge to you for this step of your journey, but we do charge a minimum of £1,000 when you receive your mortgage offer. Our minimum total earnings must be £1,500, some of which we will receive from the mortgage lender. You will be notified of this when we provide you with the mortgage illustration from the recommended lender.

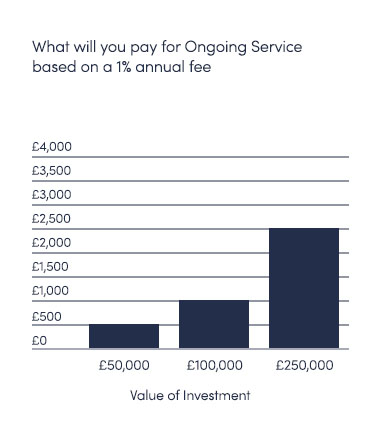

4. Ongoing service

We build long-lasting trusted business relationships with all of our clients. Whilst optional, we recommend that you continue to work with us to review your investment and pension planning on a regular basis, to ensure that they match your changing goals and objectives.

Our charges

Investments and Pensions

We will charge you a percentage of your total funds under management. This will be up to a maximum of 1% per annum. These fees can be paid to us by you or will be deducted from your investment by the product provider and paid to our network, 2plan wealth management.

Mortgages

There is no ongoing fee paid to us.

Equity Release Mortgages

There is no ongoing fee paid to us.

Please note that we do not charge VAT for our services where we act as an intermediary between you and a product provider.

Fee Examples

If you would like to find out how we can help you to plan for today, tomorrow and the unexpected, why not get in touch?

My wife and I met with Mark to discuss Equity Release. From the outset Mark was professional in his approach and put us at ease. The advice he gave was clear and concise and he explained our options in detail and in a manner that was easy to understand.

1. What were the circumstances that caused you to initially look for an adviser? I wanted a good income protection plan. 2. How has Mark Bastable helped you? He helped me get some income protection plans with great price. 3. Have you seen the outcome you were hoping for? Yes. 4. In what circumstances would you recommend Mark to a family member, friend or colleague? I would consider recommending them to anyone who expressed a need to speak to an adviser. 5. Did you read reviews of your adviser on VouchedFor.co.uk before becoming a client? No, I didn't read reviews. 6. Has Mark asked you to refer / recommend them to people you know? No 7. How were your circumstances discussed as part of the process? They listened to my circumstances, and I felt they fully understood them. 8. How comfortable did you feel discussing sensitive personal information through the process? I felt quite comfortable. 9. How confident are you that Mark found you the most suitable insurance / protection policy for you? Confident. 10. How confident are you that you understand the impact of your circumstances on your policy? I have some understanding of how my circumstances impact the premium and/or exclusions on my policy. 11. How did Mark and their firm earn money from working with you? They earn commission on the policy from the provider, which does not impact the premium. 12. Would you still be able to make a claim on your insurance if you don’t keep up your payments? No. 13. Do you have a policy that provides a payment if you were to pass away (Life Insurance policy)? Yes, taken out privately. 14. Do you have a policy that provides a lump sum if you are diagnosed with a life changing illness? (Critical Illness Cover) Yes, taken out privately. 15. Do you have a policy that provides an income if you are off sick? (Income Protection policy) Yes, taken out through Mark and/or their firm. 16. When would you next prefer to review your protection needs? Not sure. 17. How would you prefer to kick-off the next review of your protection needs? I would prefer my protection adviser to contact me. 18. Did you ever have to chase the adviser or their team to get things done through the process? Never. 19. How responsive was the adviser / their team? Very responsive. 20. How easy was it to share documents with your adviser / their team? Very easy 21. How do you engage with the correspondence you receive from Mark and/or their firm? I quickly look for the most important parts. 22. How clear is the correspondence you receive from Mark and/or their firm? Clear.

1. What were the circumstances that caused you to initially look for an adviser? In 2015 we wanted to find and advisor who we could trust to give good independent advice to safeguard our investments. 2. How has Mark Bastable helped you? We have remained with Mark since 2015 which should indicate the trust and confidence that we have continued to place in his advice. Mark is always approachable and is always prepared to spend time on research before giving appropriate advice. 3. Have you seen the outcome you were hoping for? We are investing for the long term and to date our investments have shown that we are in safe hands. 4. What could they have done better? Nothing

My wife and I have used the services of Mark for many years. We have always found him to be completely honest and trustworthy and he has guided us professionally with any requests that we have made. His advice is always thorough and he has helped us to make sound investments and plan for our retirement. We would definitely recommend Mark.

Mark’s advice to us as first-time buyers was invaluable. He was friendly, professional, always contactable and extremely efficient, providing advice about suitable mortgages, solicitor recommendations and life insurance policies. Would highly recommend!

I have known Mark for many years now. Throughout he has been trustworthy and very patient with my questions. Over the years my needs have changed but I can still rely on Mark to find the right product for me. I am very happy with his services.

What could Mark have done better? Can’t think of anything. What were the circumstances that caused you to initially look for an adviser? When I left a corporate company and needed to organise a private pension. How has Mark helped you? In every aspect of my private pension and savings. Have you seen the outcome you were hoping for? Yes absolutely. I would have made some bad choices without Mark’s advice

Mark has provided us with financial advice for many years with particular focus on pensions, ISAs and reducing our inheritance tax liability. We have no hesitation in recommending him.

Mark has been our financial adviser for several years and continues to offer an excellent level of guidance and support. Specifically, he has helped with mortgage and investment advice taking into consideration our long term retirement objectives. We continue to use Mark's services as he understands our financial circumstances and explains how best to achieve our future goals. The advice Mark provides continues to keep us informed and we feel he is always looking at the best strategies to help our investment grow.

I contacted Mark for advice for the best use of an inheritance and my retirement plans. Mark was very informative and explained my options clearly and thoroughly. He responds quickly to any questions and is very customer focused.

Rating & Summary: Overall 5* Advice 5* Service 5* Value 5* What could they have done better? We have been very satisfied with Mark & Templegate Financial Planning's advice so far and thus from our knowledge we cannot really point to any suggestions or improvements What were the circumstances that caused you to initially look for an adviser? Originally we took the opportunity of using Mark sometime ago to re-mortgage and invest some money which worked very well so later on when looking at forthcoming pensions and retirement in general Mark was a natural choice. How has Mark Bastable helped you? Mark has advised us on several Pensions and also our financial position for some time now and will do for the foreseeable future in trying to achieve the best balance for our retirement planning Have you seen the outcome you were hoping for? Mark had evaluated our positions and future aspirations before coming back with advice that should improve further on earlier investments going forward which is something very reassuring.

I highly recommend Mark Bastable. After a detailed Financial Review, he patiently explained my pension options and advised me on tax and inheritance implications. All my emails were promptly addressed, and his responses were clear and easy to understand.